The costs of nearly everything in the United States has gone up recently. The costs of food, gas, houses, etc are all up from where there were just a year ago. In fact inflation is at a 40 year high with reports saying it will only get worse with the recent invasion of the Ukraine (Carlson 2022). In the same article it states that Russia and Ukraine produce about 30% of Europe’s wheat meaning prices on wheat and wheat products are expected to increase.

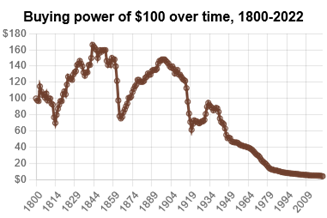

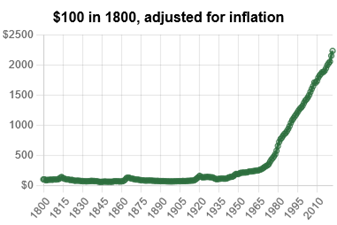

Inflation isn’t something new though as the value of the U.S. dollar has been decreasing in value since it was first made in 1792 when the dollar was established as the currency of the United States. When the dollar was first made it’s value was much higher and has steadily decreased in value and buying power since as shown in the graphs below. According to officialdata.org the dollar has lost 96% of it’s value since 1800 (officialdata.org 2022).

Inflation is also not unique to the United States as other countries experience inflation just as the United States. There are many factors that attribute to inflation such as wealth and GDP of the country, amount of money that is in circulation, the interest rates set by the federal reserve, whether the currency is backed by a precious metal or not, and other factors. Some countries have experienced hyper inflation where their currency values plummet to the point of no return. In Zimbabwe for example they had to abandon their currency and adopt the U.S. currency (and many others) for their official currency (XE 2022). Zimbabwe’s currency notes were in the billions and still nearly worthless. For example in 2008 a loaf of bread cost $10 million in Zimbabwe’s currency and those costs increased daily as inflation continued to rise (Baldauf 2008).

A similar situation happened in Venezuela with currency plummeting to a value of 1,000,000 equaling about 32 US cents. Venezula announced that it would create a new currency with an exchange rate of 1 to 1,000,000 (Al Jazeera 2021).

Currently the United States is not experiencing such extreme inflation as Zimbabwe or Venezuela did, but the trend is somewhat alarming and cautionary. The recent inflation cause be attributed to COVID-19 both directly and indirectly along with other factors. COVID not only directly affected people by making them sick and unable to work, but indirectly with mandates that shut down much of the country. With less people working, less products are being produced and shipped, from simple supply and demand that would equate to a rise in costs. There has also been a push for higher wages through out the country. The money to pay the workers has to come from somewhere. The companies could take in less of a profit or increase costs to consumers and it appears those costs have been passed on to the consumer.

As shown in the trend above the value of the dollar started to make it’s worst devaluation around the time when the U.S. dollar quit being backed by gold. The United States adopted the gold standard in 1900 which made the U.S. dollar equivalent to 1.672 grams of gold or about $18.60 an ounce. The gold standard was suspended multiple times during the first world war and during the great recession. During this time silver certificates were created which allowed for those dollars to be backed by silver opposed to gold. There were also certificates that were printed that were labeled with “will pay to the bearer on demand”. These certificates weren’t backed by anything except the dollar. In 1933 the gold standard was eliminated except for in foreign trade. The move was was considered temporary by many, but by 1971 the United States dollar lost all official ties to gold. Without the dollar being backed by anything anymore the dollar was left to be valued by the market which has many factors. The amount of money in circulation, the federal interest rates, the economy and other factors determine the value of the dollar now and therefore inflation and/or deflation of currency.

Inflation affects everyone as it not only lowers the value of our money, but it can affect the economy too potentially costing jobs. As inflation increases the cost of goods and services it makes it more expensive. As goods and services become more expensive from inflation consumers are either going to have to skip getting their good or service or get less of their good or service. As consumers get less goods their demand will go down which could mean that costs will also go down as a result, but could also mean that companies produce less. If companies produce less goods their need for workers will go down potentially costing jobs and further slumping the economy.

The United States and global economy was in a decline, but has more recently been improving. In 2021 the U.S. had a record 6.4 million jobs added after millions of jobs were lost in 2020 (Pickert 2022). There are signs of the economy recovering from the pandemic which could help slow inflation rates, but with new issues in the Ukraine could strain not on the U.S. economy, but the global economy.

Citations

Al Jazeera (2021). Al Jazeera. https://www.aljazeera.com/economy/2021/10/1/venezuela-introduces-new-currency-drops-six-zeros

Baldauf, Scott (2008). In Zimbabwe, bread costs Z$10 million. The Christian Science Monitor. https://www.csmonitor.com/World/Africa/2008/0325/p06s02-woaf.html

Carlson, Debbie (2022). US Inflation at 40 year high, Russia’s war will only make it worse. The Guardian. https://www.theguardian.com/business/2022/feb/27/russia-ukraine-inflation-us-oil-economy-green-energy?amp;amp;amp

Officialdata.org (2022). Inflation since 1800. Officialdata.org https://www.officialdata.org/us/inflation/1800

Pickert, Reade (2022). U.S. Sees Record Job Growth in 2021 After Millions Lost in 2020. Bloomberg. https://www.bloomberg.com/news/articles/2022-01-07/u-s-sees-record-job-growth-in-2021-after-millions-lost-in-2020

XE (2022) ZWD – Zimbabwean Dollar. XE. https://www.xe.com/currency/zwd-zimbabwean-dollar/